With Wells Fargo Bill Pay, you can set up one-time payments or recurring payments for fixed bills such as your mortgage or car payment. You control your payment schedule by deciding how much is paid and when. Payment scheduling is available up to one year in advance. You can pay bills online from any of your Wells Fargo checking accounts or credit cards.

Individuals and companies that are not set up for electronic bills receive paper checks. This bill pay service cannot provide payments to federal, state or local tax agencies. The company sends you an email to let you know when payments have been sent. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®.

Available to almost anyone with a U.S.-based bank account. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®.

To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. Your mobile carrier's message and data rates may apply.

U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement.

Your mobile carrier's message and data rates may apply. Like many financial institutions, Wells Fargo provides a few options for paying your credit card bill online. Online bill payment is a secure electronic service that allows customers to pay bills without having to write checks and mail them. Online bill payment usually is tied to a checking account from which funds are withdrawn electronically for payment of one-time or recurring bills. Online bill payment is offered by many banks and bill-pay services. 1Send Money with Zelle® is available for most personal checking and money market accounts.

Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To send money for delivery that arrives typically within minutes, a TD Bank Visa® Debit Card is required. Message and data rates may apply, check with your wireless carrier. Connie banks with a major financial institution that offers full online banking services, including bill pay. She signs up for the service at her bank's website.

She enters the key account information for each of her creditors and schedules payments for specific dates each month. Now, Connie travels with peace of mind, knowing her bills are being paid on time. She can also check her account using a mobile computing device, such as her smartphone, while on the road. FNBO makes payments over the internet or-- if the merchant does not accept internet payments--using traditional paper checks sent through the mail.

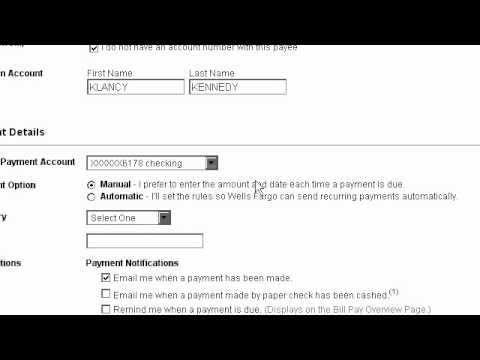

You can manually add Wells Fargo auto leases, home equity loans, lines of credit and mortgage accounts. It has a database of payees to save you time when adding accounts, but you can also enter information manually. You enter your payee's information once and Wells Fargo saves the information to make repeated transactions easier. This bill pay service saves you time and effort in managing your bills. And if you make a manual payment, it can foul things up.

But there also are benefits because online bill pay because bills are paid on time and can boost your credit rating. Connie travels a lot for her job and has unintentionally paid bills late before because she was not home to retrieve her mail and write and mail checks on time. She has a mortgage, car loan, utility bills and a couple of credit card bills to pay each month. Connie has heard many of her colleagues and friends say they enjoy using online bill payment, so she inquires about the service at her bank. Because of the time it takes to remit your payment to the payee, they will not receive payment on the processing date .

Therefore, in order to provide sufficient time for payments to be received by your payee, the processing date should be at least five business days before the bill's actual due date. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off.

For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply. This bill pay service alerts you when payments are due.

You can choose to receive e-bills from participating billers for no extra charge. Wells Fargo tells you how many days to allow for delivery when you set up a payment. Most electronic payments take 3-5 days, and paper checks may take up to five business days. Wells Fargo guarantees your payment will be sent as scheduled and all your information is secure.

Online bill pay service, offered by many banks and credit unions, makes it easier to organize your bills and pay them when they're due. If you juggle rent or a mortgage, cable and electricity bills, credit card payments and more, online bill pay can save time and help you avoid late fees. Wells Fargo Bill Pay makes paying your bills from your Wells Fargo banking account easy. This bill pay service sends funds to almost any individual or business in the U.S. from your eligible Wells Fargo account. You control your payment schedule and can set up one-time payments or recurring payments. You choose how much to pay and when, and this bill payment service does the rest.

I'm a consultant and m one of my main clients pays my bills via Wells Fargo online billpay. They draw the money immediately from his account and schedule a 5 business days delivery date to deliver me the check. These checks are now consistently late or they are misteriously lost in the mail and never arrive. The client is now complaining that this is now happening to other people he sends checks via bill pay with Wells. You'll generally have to own a checking account with a bank to use its bill pay service.

Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions.

Fiserv is a company that handles online bill pay functions for a fee; $5.95 a month for the first 15 transactions, plus 50 cents for each additional payment. Another non-bank based bill pay service, PayTrust.com , also lets users pay bills electronically. The company charges $9.95 per month for 25 transactions plus 65 cents per additional transaction. One downside of the service--receiving a bill and paying a bill are considered two separate transactions, boosting the cost, according to The New York Times Co.'s ConsumerSearch.com . Bank of America's online bill pay service is free for checking customers and includes unlimited payments.

The bank's web-only checking is also free as long as customers receive statements online and conduct deposits and withdrawals at bank-owned ATMs. Depending on the payee, this can happen within minutes or may take up to one billing cycle. Each payee may have different rules about continuing to send paper statements; so it may be possible to receive paper bills and eBills depending on the company you select. You will receive an alert at your personal email address when you have new eBills ready to view in online banking, and can print copies of all your bills to retain for your records. It offers online bill payment facility to all its users and provides several different methods to pay bills.

You can pay your bill online at Wells Fargo Bank's website, mail your payment to the processing center, or pay your bill in person at any authorized location. It also provides you with the option to set up automatic bill payments online and make alternative payment arrangements. You can also cancel account and contact customer support online. Business Bill Pay includes Wells Fargo's Bill Pay Payment Guarantee - your business payments will be sent as scheduled. Make recurring payments with your business debit card.

Use your business debit card to pay bills such as office utilities, internet and phone services, equipment leases, and more. Online Banking and Mobile Banking offer convenient methods to access your Wells Bank accounts. You can perform a variety of banking services online, whether by computer or other internet device. Automatic payments scheduled through Bill Pay will be subtracted from your balance on the date you requested unless it is a non-business day.

Payments scheduled on non-business days will be subtracted from your balance on the business day prior to the scheduled payment date. Note that Bank of America credit card payments from a Bank of America account, personal or small business, can be paid any day of the week. Bill Pay is an online service that allows you to pay your bills through Bank of America's Online Banking.

You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online®. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts. Online bill pay services range from free to $9.95 per month. At Virginia-based Presidential Bank , online bill pay is free for customers with interest-bearing checking accounts with at least a $500 balance.

Another checking account requires a $100 minimum balance, but does not accrue interest and charges $5.95 per month for the first 10 bill payments plus 40 cents for each additional one. An eBill is an electronic version of your paper bill or statement that you can view and pay online. Many large companies, like your electric, phone, cable and major credit card companies can send you eBills. Some payees who offer eBills also offer a recurring payment option.

For eBills, you can set up recurring payments for the minimum amount due or full amount due. This is helpful for recurring bills where the amount may vary month to month, such as payments for credit cards, utilities or a phone. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, and an active unique e-mail address.

Chase Bank serves nearly half of U.S. households with a broad range of products. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more, visit the Banking Education Center. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Overdraft Protection is an optional service you can add to your checking account by linking up to two eligible accounts .

We will use available funds in your linked account to authorize or pay your transactions if you don't have enough money in your checking account. The service is subject to applicable transfer and advance fees. Overdraft Protection is not available for Clear Access Banking℠ accounts. For more information, please refer to the Deposit Account Agreement and Fee and Information Schedule applicable to your account, or visit wellsfargo.com/overdraftservices.

Set up automatic payments through your bank account at no cost to you. Upon your authorization, your financial institution will automatically deduct the bill amount on the due date each month. Automatic bill payment eliminates the hassle of writing a check and mailing your payment and guarantees that your payment will arrive on time. Paperless electronic billing from Connexus Energy offers many benefits – for our members and for the environment. The electronic billing option allows member to receive, view, and pay bills online with no additional fees. EBill reduces paper usage and associated costs, including postage, making it easy to go green.

As First National Bank of Arizona Vice President of Marketing John C. Sack explained "Even so, it's really a step between where we are and where we have to go with banking. In 1995, Wells Fargo made history as the first bank to enable customers to pay bills and track payment history in one, secure place online using its Online Bill Pay. Despite its instant popularity, the Supercheck and all check based bill pay tools had their limitations.

Customers could not add business names to the list. Using the check successfully also required careful planning by customers to time payments correctly. For electronic payments funded from a prepaid card, such as BB&T MoneyAccount® or MyLink Card, funds are withdrawn 2 business days prior to the Deliver By date. For paper check payments funded from a prepaid card, funds are withdrawn 5 business days prior to the Deliver By date. Although a number of your payees accept payments electronically, many do not.

For those that do not accept electronic payments, we must send a check to that payee through the U.S. mail. Once the check is received by the payee, it may also take a day or so for that payee to process the check and post it to your account. Even for electronic payments, it may take two or three days for your account to be posted. The first thing you'll need to do is gather your information (names, addresses, account numbers, etc.) about everyone you want to pay through Electronic Bill Pay. A 2019 study by financial-tech firm Fiserv found that nearly a third of people age 65 and older did not use online or mobile payments.