Funds may not be available for immediate withdrawal. We typically make funds from your check deposits available to you on the business day we receive your deposit. For determining the availability of your deposit, every day is a business day, except Saturdays, Sundays and Federal holidays.

If you make a deposit before the close of business on a business day that we are open, we will consider that day to be the day of your deposit. However, if you make a deposit after the close of business or on a day we are not open, we will consider the deposit was made on the next business day we are open. Please note that you will receive a confirmation that your deposit was made, however you may not see it reflected in your account balance immediately. Account balance inquiry may not reflect unprocessed debit card transactions, checks and deposits. This interest-earning checking account offers customers with more perks than the bank's other bank accounts combined.

You'll still have access to overdraft protection, buffers and fee erasers. But being a Premier client enables you to earn triple rewards points on a World Mastercard® credit card and use your Premier Mastercard® debit card at any ATM in the world for free. Your debit card will also carry higher transaction dollar limits, chip technology and fraud protection. $1/transaction fee applies (non-refundable) and will be combined with transaction amount. Requires an active debit card to initiate transaction.

Transaction amount including fee is deducted from available balance immediately but may not settle on the same business day. Insufficient or Bounce fees may be incurred if adequate funds are not available at settlement. Funds may not be available to the recipient the same business day as transfer.

Fee is not refunded if recipient does not claim funds. Message, data rates, and transaction limitations apply. Bank of the West provides checking, savings, credit cards, mortgages, auto loans, business banking, commercial banking and more. Bank of the West pairs the mobile and online banking capabilities of a world-class global bank with the personal attention of a local bank.

The Bank of the West of Thomas, Oklahoma operates as a full-service bank. The Bank offers savings and checking accounts, deposit, loans, insurance, investment, bill payment, cash management, debit and prepaid cards, and online banking services. The Bank of the West serves customers in the State of Oklahoma. Standard carrier fees for data and text messaging may apply. Key Features Details Minimum Deposit $100 Access to Your Checking Account Online, mobile, over the phone and at physical branches. Security FDIC insurance up to the maximum amount allowed by law.

These additional deposits must be at least $100, but you can make them at any time. They will earn interest at the rate the account earned when you opened it. It's important to remember that this account is still an IRA. That makes it subject to IRA contribution limits that you have to be aware of. Exceeding these limits can get you into some trouble with the IRS. You can access your money wherever you can find the bank.

This means at a branch, ATM, online, over the phone or on its mobile app. Whenever you want to access your money at an ATM, you'll need your Bank of the West debit card and PIN. Be ready to have your personal and account information ready when you want to access your money through any other method. Bank of the West has customers in all 50 states and operates more than 700 branch banking and commercial office locations in 19 Western and Midwestern states.

Prudent credit underwriting, a diversified loan portfolio, and careful risk management have allowed them to grow to more than $62 billion in assets. They are one of the nation's largest banks, yet preserves their local feel and their award-winning style of relationship banking that ensures superior customer service. Banking, credit card, automobile loans, mortgage and home equity products are provided by Bank of America, N.A.

And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Programs, rates, terms and conditions are subject to change without notice. Zelle in our mobile app is a fast, safe way to send and receive money with friends, family, and businesses you trust no matter where they bank in the U.S. -- with no fees in our app. If it's your first time using Zelle, tap Setup. Follow the prompts to enroll, which include adding your U.S. mobile number or email that others can use to send you money.

Say you want to send $20 to Tim for yesterday's lunch. Enter Tim's contact information or select Tim from your contact list. Enter the amount, select the account, and tap Continue.

Verify Tim's information is correct, then tap Send. If he's already enrolled with Zelle, Tim will get a text or email saying you sent him money, and the funds will go directly to his bank account. If he's new to Zelle, the text or email will include a link with instructions on how to receive his money. You can also request money, like rent from your roommates, or to split expenses for that weekend trip. Keep in mind, with Zelle your money moves from your bank account to someone else's in minutes.

So it's important you know and trust who you are sending money to and never use it with others who you don't know, or to pay for goods and services you have not yet received. So next time you need to send or receive money, just open your Bank of America app and tap Transfer | Zelle. When you have this money market account, you'll never face fees for deposits and withdrawals you make at a branch or ATM. Don't forget that as a savings account, money market accounts still limit your outgoing transactions to six per statement cycle.

Fifth Third Bank is part of the Allpoint®, Presto! Customers of Fifth Third Bank can use their Fifth Third debit or prepaid card to withdraw cash fee-free from any domestic Allpoint® ATM in addition to Presto! ATMs located in Publix stores, and 7-Eleven® ATMs listed on our ATM locator on 53.com or on our Mobile Banking app. Fees will apply when using your credit card at any ATM to perform a cash advance or when using a credit card to withdraw cash at any Presto!

ATM. ATM fees may apply to certain 7-Eleven® locations in Oklahoma, Hawaii, and Alaska. Any 7-Eleven® location listed on our ATM locator is fee-free. As a checking account, you'll receive a free Mastercard® debit card. You can use this card for free at any Bank of the West location or ATM. If you use any non-Bank of the West ATM, the bank will charge you $2.50 for each withdrawal.

Bank of the West makes its simple checking account accessible to more customers with its "any deposit" amount allowances. You can open the account with any amount as your deposit. Plus, you can easily avoid the monthly fee by making a deposit of any amount each statement cycle. There is no minimum you need to meet to save your money. You have a number of opportunities to earn higher and higher interest rates with a Bank of the West Choice Money Market account.

For starters, you should link your money market account to a Bank of the West checking account. That will unlock a whole new set of balance tiers. The exact rates will depend on the checking account you open and link. Further, there's a balance sweet spot for each set of rate tiers. Your new UCO Broncho Select Club checking account will come with a Central Card.

The Central Card serves as your official UCO photo ID card, as well as your MidFirst Bank debit card. You will be notified when your Central Card is available for pickup on campus. In the interim, you will receive a MidFirst Bank UCO debit card to access your UCO Broncho Select Club checking account. Your new ASU Sun Devil Select Club checking account will come with a Pitchfork Card. The Pitchfork Card serves as your official ASU photo ID card, as well as your MidFirst Bank debit card.

You will be notified when your Pitchfork Card is available for pickup on campus. In the interim, you will receive a MidFirst Bank ASU debit card to access your ASU Sun Devil Select Club checking account. Everyday Banking With the Bank of America Mobile App, managing your money has never been easier or more secure.

Customize your dashboard just the way you like it. You can conveniently deposit checks anytime from almost anywhere. And manage all of your bills in a single place. And stay in the know with Security and Account alerts. Use My Rewards to view all of your rewards in one place. Replace a lost or stolen card OR lock and unlock your debit card, all with a few clicks.

And you'll have easy access to your statements… All to help you stay on top of your finances with the Bank of America Mobile App. While the account earns at the lowest interest rate in the industry, you won't face fees for deposits and withdrawals when you make them at a branch or ATM. As a savings account, you're limited to six outgoing transactions per statement cycle. Each transaction over that limit will incur a $15 fee.

This site is designed to help people locate their bank's nearest branch locations, lobby hours, and online banking information. This site is not run by, endorsed, or associated with Bank Of The West in any way. Data is updated periodically from the FDIC's databases.

Loans, lines of credit and credit card products are subject to credit approval. See your Treasury Services Rep for details and pricing. Message, data rates, fees, deposit restrictions and other qualifications apply. Kids Checking accounts are for individuals under the age of 18, and a parent or guardian is required to be joint owner or custodian on the account. A monthly fee of $2 will be assessed for accounts receiving a paper statement. The catch for those who are eligible to open an account is that Bank of the West doesn't offer the best rates in the industry.

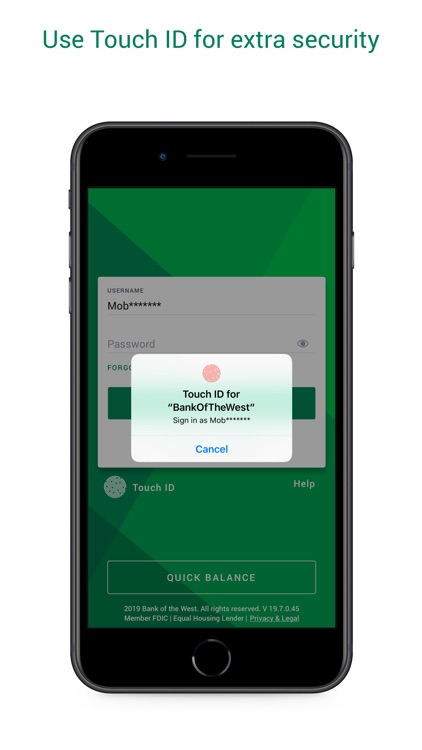

Most accounts have interest rates well below the national average. These accounts also have high minimum deposit requirements and monthly fees. Online and mobile banking both allow you to check on your balances, make transfers, deposit checks and more.

The mobile app is also equipped with security measures like Touch ID. Most of the following bank accounts have minimum deposit requirements and charge monthly fees. It's important to check those out so you don't get blindsided when you open an account.

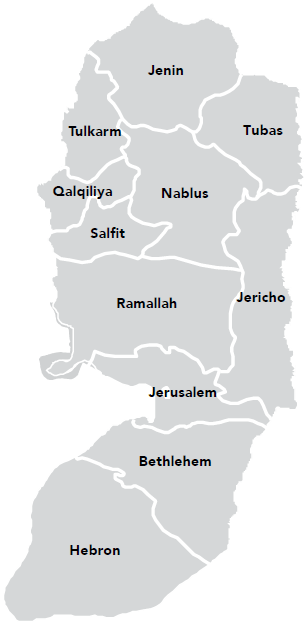

Bank of the West offers its customers the ease of online and mobile banking. When you access your account online, you can track your spending and budgets, pay bills, transfer money, set up email and text alerts and more. Locations with Bank of the West offices are shown on the map below. You can also scroll down the page for a full list of all Bank of the West Oklahoma branch locations with addresses, hours, and phone numbers information. You can click any office name for more details. Message, data rates, fees and deposit restrictions may apply.

First twelve transactions per month are free with eStatements. You can also choose unlimited bill payments per month for $5.95 a month. If you receive paper statements, the first seven transactions per month are free. Rush delivery is available for an additional fee. ATM Access Codes are available for use at all Wells Fargo ATMs for Wells Fargo Debit and ATM Cards, andWells Fargo EasyPay® Cards using theWells Fargo Mobile® app. Availability may be affected by your mobile carrier's coverage area.

Your mobile carrier's message and data rates may apply. Some ATMs within secure locations may require a card for entry. Digital wallet access is available at Wells Fargo ATMs displaying the contactless symbol for Wells Fargo Debit andWells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. By clicking 'Continue', you will leave our website and enter a site specific to making your loan payment via a debit card or electronic check. Mobile and traditional directions to this location can be found below along with ratings, lobby hours, their phone number, online banking website and additional banking information. Corporations come to us because we remain steadfast in helping them meet their business objectives.

Our range of commercial banking services will ensure your company's financial assets are in good hands. Use theWells Fargo Mobile® app to request an ATM Access Code to access your accounts without your debit card at any Wells Fargo ATM. A CD from East West Bank is a term deposit account that offers a higher rate of interest than a regular savings account.

Enjoy low minimum opening balances, competitive interest rates, ATM access and other benefits that make our savings accounts smart choices. You can also use a tap-to-pay card or a smartphone to make transactions at our cardless ATMs. Night Deposit Accepted More information about Night Deposit Accepted Night Deposits You can make deposits after business hours using the financial center's night depository. Night depository transactions are credited the following business day. Bank of the West's accounts doesn't earn at the highest rates.